LANGUAGE↓

News & Policies

Withholding Corporate Income Tax in China

Non-trade foreign currency payment refers to the fact that when a foreign company or institution generates income from labor services within China or obtains profits, interest, rents, royalties, and other income derived from China’s territory, as well as income related to capital projects, it is an act of paying foreign exchange by the domestic enterprises to foreign companies.

Foreign companies or organizations that obtain non-trade income in China’s territory usually fall into two categories. One category is positive income. Also known as income derived from non-source control, it refers to the income from the provision of labor services in China, the taxation profit rate is 10%~30% for the organization and place where the labor service is provided shall be calculated based on the approved taxable income rate, and a statutory tax rate of 25% shall apply. Second category is passive incomes, which are also known as income from source control. They refer to income from non-trade income other than income from labor services, and are subject to corporate income tax at a tax rate that applies 10% to all non-trade income income. Non-resident companies in countries with preferential tax rates agreed in the China and foreign country tax treaties may apply for preferential tax rates.

For example, Hong Kong’s double tax agreement with China reduces the withholding tax rate on dividends from 10 percent to 5 percent. This means that China-sourced dividends remitted to Hong Kong are subject to a reduced withholding rate of 5 percent.

The tax payable on income derived by non-resident enterprises should be withheld at the source, with the payer (i.e., the Chinese enterprise who remits the fund overseas) as the withholding agent.

The formula for calculating withholding tax liability is:

Tax payable = Taxable income x Tax rate

Filing procedure for withholding CIT:

Where a non-resident enterprise derives China-sourced dividends, interests, rents, and royalties, or income from property transfers, it is required to file the withholding tax either by itself or by a withholding agent.

A copy of the contract giving rise to the taxable income, along with a contract registration record form and other relevant documents, must be submitted to the authorized tax bureau within 30 days of signing the contract. All documentation, including those originally in a foreign language, must be translated into Chinese. This procedure applies to each subsequent revision, supplement, or extension of the contract.

The China withholding agent should also maintain books and records for taxes withheld and a file of the relevant contracts, which will be subject to inspection by the relevant tax bureaus. If the withholding agent fails to fulfill its obligation to withhold tax, non-resident enterprises should file and pay withholding tax to the local tax authorities where the income is derived from within seven days of the due date for tax filing and payment.

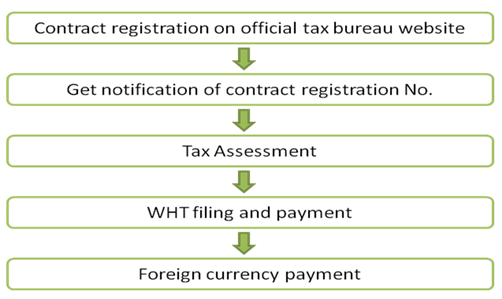

Procedure for the non-trade foreign currency payment: