LANGUAGE↓

News & Policies

The importance of annual tax return

Into the month of June, there are many things needs to be done. What is particularly important is that the 2018 tax liquidation has become more stringent. Not only it requests self-examination, but also there are major issues in May and June which if failure to deal with, it will cause major losses to the company. Therefore, AC reminds you that there are several major things that must be taken care of as below:

Annual tax return or also can be called as “annual tax liquidation”

1. Basic concept

Annual corporate income tax return and payment refers to the various types of economic entities that declare the payment of corporate income tax. When the annual final settlement and payment is completed, the audit documents submitted to the competent tax authority are required to confirm whether the conditions reflected in the corporate income tax return are true, reasonable, whether it meets the requirements of the national tax policy.

2. There are mainly two types of objects for settlement

a) The company that implements the audit collection;

b) The company that implements the approved taxable income rate.

c) Sub-branches that have trans-regional operations and collect taxes are also required to make annual liquidation as required.

Tip: Enterprises that have implemented a fixed-quota enterprise income tax collection do not need to do the annual tax liquidation.

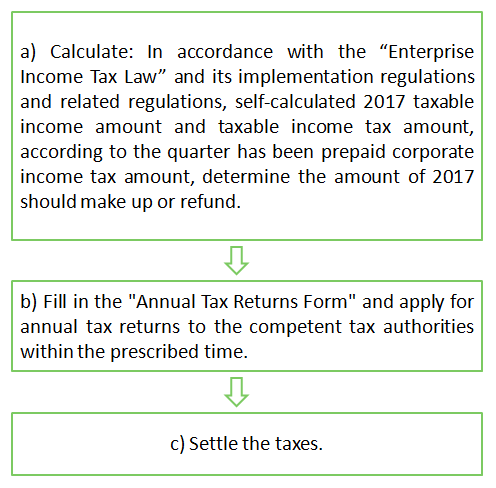

3. Annual tax return and payment procedures

4. Annual tax return time frame

Article 54 of the “PRC Corporate Income Tax Law” stipulates that an enterprise shall submit annual corporate income tax returns to the tax authorities within five months from the end of the year, and make final settlements and settle the dues or tax refund should be paid. For example, the corporate income tax payment and settlement date for 2017 will be from January 1 to May 31 of 2018.

5. Consequences of failure to settle annual tax return payments on time

a) Legal representative cannot loan to buy a house;

b) Legal representative cannot do immigration;

c) Legal representative cannot take pension insurance;

d) The company will be fined from 2,000 to 10,000 RMB each year by the tax bureau;

e) If there is any tax owed, corporate legal representatives will be prevented from leaving the country; aircraft and high-speed trains will not be available;

f) The tax bureau will visit the door for inspection if it does not declare taxes for a long time;

g) If you do not declare tax for a long time, the company can not buy the invoice;

h) The company will be registered at the Abnormal Business Directory on the Industrial and Commercial Credit Network, and all external bids are subject to restrictions for the company, such as bank accounts opening, entering the mall, etc.