LANGUAGE↓

For Business Inquiry :

Telephone: +86(21)63731202

Email: info@accontra.com

Address: Unit K & L, 12 Floor, No.33 He Nan Road (s), Shanghai, China

HK Offshore Company

Company Maintenance

Step 1 - Renewal of Company Documents

To maintain government annual charges and renew our annual parking services before due date.

We will send reminder 2 month before renewal (Incorporation date of the company) to clients and help to arrange the renewal matter.

Annual Renewal - Hong Kong Company includes:

Registered Address

Company Secretary

Government Disbursement

Total amounts HKD2,500

Note: Government penalty apples for any late renewal payment

Step 2 - Accounting (e.g. Audit Arrangement) and Taxation

We will send notice to clients to engage our tax filing and accounting services.

Tax Filing - Hong Kong

Company includes:

Employer’s Return

Profits Tax Return

Total amounts HKD1,200

Note:

The above quotation is an example only if a Hong Kong Company has not commence any business operation and no staff hiring within Hong Kong.

Extra fee applies when a Hong Kong Company has commenced business and/or staff hiring.

Tax filing fee does not cover accounting and audit fee which should be quoted separately according to certain criteria e.g. business size, workloads and etc.

Audit service is rendered by independent auditor.

3 Key Annual Maintenance Features

In Hong Kong, each company needs to file tax return on annual basis. Companies are recommended to pick either "31-December" or "31-March" as the closing date of financial reporting as same as the cut-off date of Hong Kong Government.

3 key Government departments for the annual maintenance of a Hong Kong limited company are below:

Business Registration Office (BRO)

Renew business registration (BR)

Hong Kong Company Registry (CR)

Submit annual return (AR1) yearly to record the information of current shareholder(s), director(s) and company secretary.

Note: During the year, file to the CR of any changes in the shareholdings, director(s) etc., that need to be filed according to the Companies Ordinance. The information need to be filed and ready for public search in order to protect the interest of the company and the public.

Hong Kong Inland Revenue Department (IRD)

For Limited Companies:

Profits Tax Return (16.5% since 2008/09 and onwards);

Salaries Tax (15%) (Employer’s Return 56B).

Note: Maintain proper accounting books and records to produce financial statements for tax return filing for 7 years.

Common misunderstanding

Annual tax filing are required for both active and inactive companies, hence tax demand is evaluated by Hong Kong Inland Revenue Department.

Proper books and records need to be maintained in order to support any financial statements. Hong Kong Inland Revenue Department has final rights / authority to equest companies to submit all relevant documents and records for assessment. Improper filing may incur penalties and / or estimated assessment will be levied.

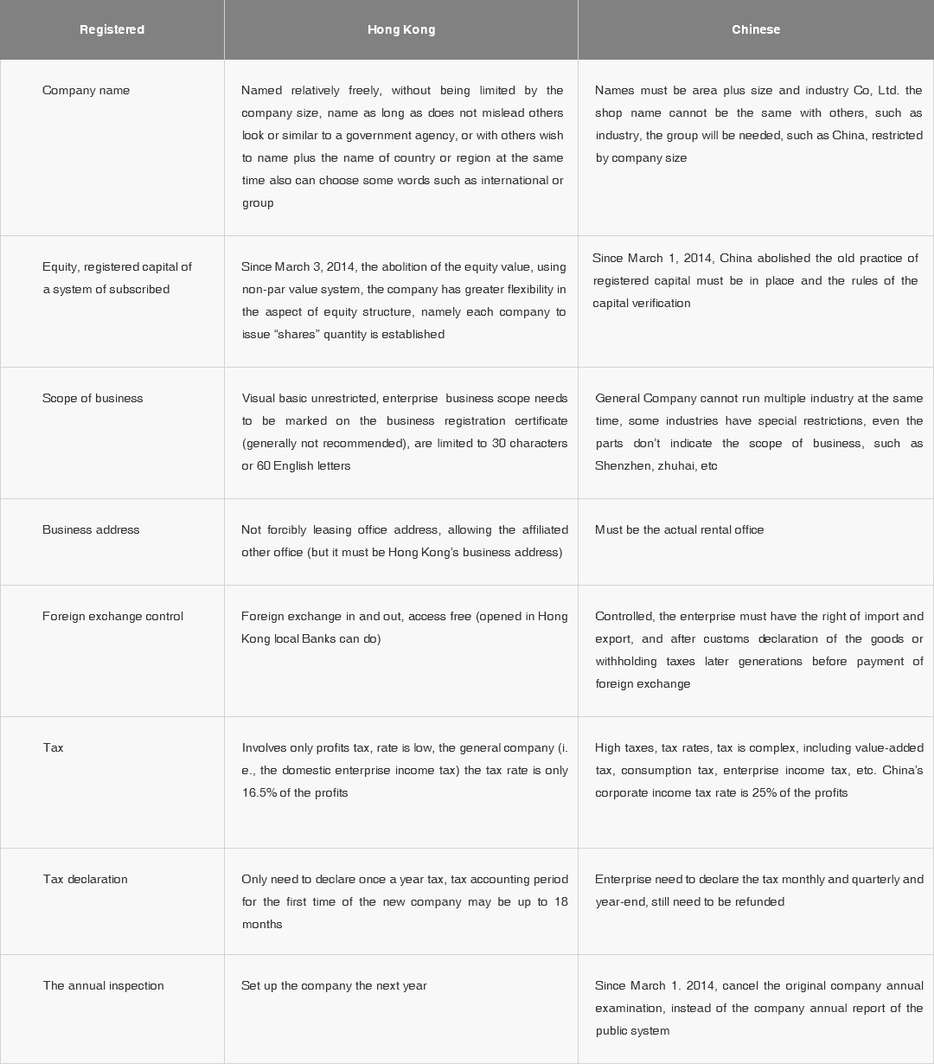

The Difference between HK & Chinese Companies